Palm Springs: $8000 Tax Credit Still Good till 4/30/11 For Military ...

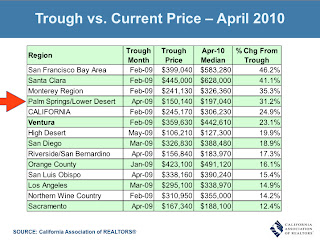

Did you know that the $8000 Tax Credit is still good for members of the Military & some Federal employees in the intelligence community until April 30, 2011 to have a binding contract, and Closing deadline of June 30, 2011. "It applies to any individual (and, if married, the individual’s spouse) who serves on qualified official extended duty service outside of the United States for at least 90 days during the period beginning after Dec. 31, 2008, and ending before May 1, 2010. " This is an great opportunity for those who are renting to take a look at buying a home. Home prices are very favorable, coupled with FHA 3% downpayment and incentives , and interest rates at their lowest , lead to a win win situation . For all the details go to IRS-First-Time Homebuyer Credit: Members of the Military and Certain Other Federal Employees Find affordable real estate in Palm Springs , Palm Desert , La Quinta , Indio , Cathedral City .